Yogurt Category Innovation Fuels Consumer Interest

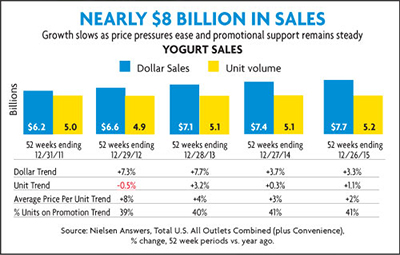

For eons, yogurt has been the ultimate superfood for many cultures and its popularity in the United States continues to grow. According to Nielsen, the yogurt category is projected at $7.7B, up 3.3% from last year. Over the last four years, the category drove $1.47B in growth, making it the 17th fastest growing category.

Greek yogurt sales are hovering at $3.7B. Major grocery retailers are expected to dedicate an extra 10-20 feet to the yogurt category over the coming years. This is in addition to the retrofitted added space they planned for 2012-2015. American consumption of yogurt is 15 lbs/yr. However, when you compare to Switzerland, which tops consumption at 61 lbs/yr., you’ll quickly see why this category is important for long-term growth. Innovation will continue to fuel consumer interest in the category.

We continue to see the consumer segmentation for yogurt evolve, moving from “product type” to “consumer end benefit”. The current decision hierarchy presents as follows: Benefit > Segment > Brand > Sub Segment > Type > Count Size > Flavor. And, at each point we see price screening the decision criteria. Meaning, the yogurt category continues to be a price-sensitive category, and while promotional spending has slowed, the importance of pantry loading strategies and value-packs remain.

As we touch upon pricing, it is important to note that higher income households are more drawn to Greek yogurt because of its quality halo. We also see an important shift around Greek yogurt with Millennials and Generation X. We see Millennials indexing 29% higher for Greek yogurt and Generation X indexing 15% higher. Our hypothesis is that both these consumer segments are drawn to the health and nutrition benefits as well as the functional/super food connection that Greek yogurt has due to its ancient roots. Making healthy food choices goes hand-to-hand with the growing popularity of wearables and fitness/food apps for these consumer segments.

Yogurt Consumers Shift to Benefit-Driven Shopping Patterns

- Benefit

- Segment: Kids, Traditional, Weight Management, Organic, Specialty, Proactive

- Brand

- Sub-Segment: Cups, Plain, Regular, Digestive, Drinks, Blended, Low/No Sugar, Low Carb, Immunity, Tubes, Flavored Light Plus, Heart Healthy, Fruit On The Bottom, All Other

- Type: Single Serve, Multi-Pack, Quart, Tube

- Count: Count, Size

- Flavor

Ten Opportunities to Consider for Next 1-3 Yrs

1. Dairy- and lactose-free options will continue to drive innovation and be important to consumers.

2. Gluten-free will continue to rise.

3. Digestive health using probiotics and probiotics will continue to remain important.

4. Protein levels as they relate to the growing popularity of the Ketogenic Diet will drive innovation. Looking at glucose interactions with fruit will spur innovation to bring in green vegetable mixes into yogurt.

5. Non-GMO ingredient options and clear labels will continue to gain traction and importance.

6. Brands with a “people, planet, profit” platform will out-pace legacy brands that do not have them.

7. Focusing on the fact that yogurt is one of the first superfoods is a clear opportunity for most yogurt brands. Taking a deep dive back into history about the origins and uses of yogurt can be fertile ground for innovation.

8. An untapped segmentation opportunity for yogurt brand managers to explore for innovation purposes is “Connections/Occasion” based segmentation, such as Anytime Snack, Snooze Food (i.e. the protein before bed is a healthy snack), Entertaining, and Morning Breakfast.

9. Premium Greek offerings that target the Millennial and Generation X consumers are a key growth opportunity.

10. Functional super foods continue to gain traction and offer alternatives to typical ingredients. For example, organic Camu has 1180% of recommended Vitamin C in 5g serving. Sprouted Chia powder is loaded with Omegas and has nice flavor in yogurt. Goji powder can really help the nutritional panel and has a berry taste, and the same is true with Pomegranate powder and Yacon syrup, with Inulin as a Probiotic also growing in popularity.

11. With the yogurt category projected to be $8B in the next few years, there is much room for innovation and new product development. This is certainly an exciting and interesting category for us to watch!