The New Grocery Landscape, Is It Fleeting or Here to Stay?

With all the changes wrought by the coronavirus pandemic, only a crazy person would try to predict which of those changes in the grocery industry will stick and which will fall by the wayside. Well … here I go.

In July 1848, Jean-Baptiste Alphonse Karr, editor of Le Figaro and a novelist (mostly romances), wrote, “Plus ça change, plus c’est la même chose.” In English this is usually said as, “The more things change, the more they stay the same.” But this translation misses a nuance of the phrase in French. More exactly it should be, “The more things change, the more it’s the same thing.” A subtle difference, but one that is telling in the current situation.

Yes, shopping and food preparation habits have changed dramatically, but the natural tendency is to fall back on the “same old thing.” That’s where consumers are most comfortable. And that is why permanent change at a deep level is difficult to enact, even though on the surface it looks like things have changed a lot. In the grocery landscape here are a few items in the “more things change” category, and a couple that will go back to the “same old thing.”

More Things Change:

BOPIS

The forced experimentation with online grocery shopping has accelerated a trend that started before the pandemic but has fast-forwarded it three to five years. Yes, some consumers will go back to their old habits, but a lot of people who had never tried online grocery shopping, either for delivery or BOPIS (buy online, pickup in store), have found it extremely convenient and hassle-free. Consumers are even showing increasing comfort (perhaps out of necessity) with ordering fresh produce online. In the last six months nearly one-third of shoppers have tried “click and collect” (an alternative name to BOPIS; it will be interesting to see which name sticks!) for the first time. Many will stick with this new habit. All the major supermarket chains, and a lot of smaller ones, have scrambled to add or upgrade these services for their customers.

Powerful Texas regional player H-E-B just added two-hour delivery with no fees or minimum order, on top of their normal curbside pickup or home delivery options. Also in Texas, the United division of Albertsons teamed up with Radius Networks to use location-based technology to accurately predict customer arrival times, which improves efficiency and reduces wait times. And Walmart is rapidly expanding its two-hour delivery option from a pilot program of 100 stores in April to over 2,000 stores this summer. Aldi, after a very brief test, immediately announced that they would expand curbside pickup to 600 stores.

Independent grocers refuse to be left behind. Online platform Mercato allows independents to start offering their customers online shopping and delivery almost instantly – without having to develop their own systems.

The big winners, however, appear to be Walmart and, most of all, Instacart. Although Walmart’s share of online ordering dropped in March, this was mainly due to Instacart’s surge and the overall rise in volume in the category. Walmart handled the dramatic increase in grocery orders much better than Amazon, which of course had to deal with a meteoric rise in orders across all categories. Amazon even closed several Whole Foods stores to customers. They converted them into delivery fulfillment centers to try to keep up with orders. Interestingly, Walmart has announced that its Walmart Grocery app is being merged with the overall Walmart app. In their announcement they said it would be more convenient for customers to be able to order everything Walmart has to offer in one place. It’s hard to argue with that – but may raise the question of why it took them so long to figure this out.

Plant-Based Eating

Concern over COVID-19 raised everyone’s awareness about the need to live a healthy lifestyle. The trend toward plant-based eating was already strong before the pandemic but has probably accelerated more than any other healthy-eating measure since this all began. Meat shortages, concern over safety, increased meat prices and sustainability concerns contributed to the continued momentum, along with the desire to be healthy during the pandemic.

While plant-based burgers are all the rage (Beyond Meat sales were up +233% in March vs. a year ago), the category has greatly expanded. On top of beef, many breakfast/pork alternatives have been introduced this year. Impossible Foods, Nestlé, Kellogg’s and Beyond Meat all launched products in the breakfast space. Trader Joe’s added “turkeyless” protein patties. And plant-based cheese, tofu and tempeh products have all shown dramatic growth, too.

While plant-based burgers are all the rage (Beyond Meat sales were up +233% in March vs. a year ago), the category has greatly expanded. On top of beef, many breakfast/pork alternatives have been introduced this year. Impossible Foods, Nestlé, Kellogg’s and Beyond Meat all launched products in the breakfast space. Trader Joe’s added “turkeyless” protein patties. And plant-based cheese, tofu and tempeh products have all shown dramatic growth, too.

Contactless Shopping

Walmart recently announced that they were launching a contact-free payment option using the Walmart app and a QR code. And they have curbside pickup where customers open their trunks and the associate puts their order into the car without any customer interaction.

Kroger, Publix, Meijer, Wegmans and Walmart (what aren’t they trying?) are all testing smartphone apps that allow you to scan your own groceries as you shop and check out without waiting in line. The double benefit of safety and convenience is hard to beat.

And in a sign that things will never go back to the way they were, Amazon has begun selling its cashier-less checkout technology to other retailers. “Do customers like standing in lines?” Dilip Kumar, Amazon’s Vice President of Physical Retail and Technology, asked, presumably rhetorically.

Same Old Thing:

Cash

Reports of the demise of cash are overblown. I don’t have a lot of evidence to support this, but it’s important to share nonetheless. On the face of it, this opinion seems to contradict my prediction that contactless shopping is going to be an ongoing trend. But I think it may take a while for cash to go away altogether. Amazon is reported to be rolling out supermarkets without Amazon Go technology, with old-fashioned checkouts. If even Amazon is willing to take cash, the end of cash is still at least a few years off.

Home Cooking

Much has been made of the explosion in home cooking brought about by necessity since going out to eat became virtually impossible. (Have you named your sourdough starter yet?) A recent survey reported that half of all respondents said they will continue to do more home cooking after the pandemic ends.

But let’s face it, home cooking is a lot easier when you are quarantined and can’t leave the house. Once those two-hour-a-day commutes to and from the office are back, scratch cooking will become just as much of a chore as it always was. Sure, there will be those brave souls who decide they are going to stick with their new cooking habits, but for the majority of us, time pressure will reignite the allure and convenience of prepared foods and takeout.

Center store categories that have seen a boost in sales from pantry loading and scratch cooking should not expect to maintain those gains. And the increase in produce sales during this time is informative. Not surprisingly, the fresh gains were strongest for items with a longer shelf life like potatoes and onions, as well as frozen and shelf-stable fruits and vegetables. This indicates that the changes were more driven by the desire to be sure food was available than a renewed interest in creative cooking.

What to Do About It

The changes in shopping behavior open up opportunities at the same time as they pose challenges for CPG manufacturers and fresh food suppliers. If home delivery or curbside pickup continues to grow, impulse purchases will inevitably decline. If less frequent shopping trips become the norm, finding other ways to reach customers becomes all the more important. One idea manufacturers are exploring is direct-to-consumer sites, following the lead of many hard-goods and apparel manufacturers.

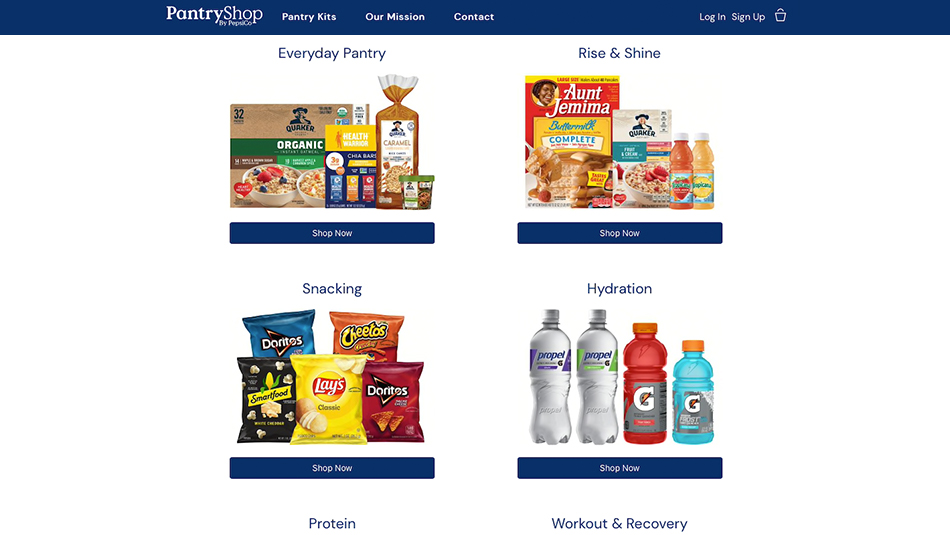

Some examples are quite surprising. Despite their growth at retail, Impossible Foods has launched their own website offering two-day delivery. Perhaps even more surprising, PepsiCo has launched not one but two sites: PantryShop.com and Snacks.com. Snacks.com offers Frito-Lay products, while PantryShop.com clusters products from Quaker, Gatorade, SunChips and Tropicana based on consumers’ need states rather than specific brands. The whole concept went from ideation to execution within 30 days.

The magnitude and speed of change brought on by the pandemic require a similar willingness to try previously unthinkable options, and to try them quickly. Even existing, successful websites would do well to try reconfigurations that somehow emulate the browsing and impulse purchase behaviors that brick-and-mortar supermarkets offer.

The magnitude and speed of change brought on by the pandemic require a similar willingness to try previously unthinkable options, and to try them quickly. Even existing, successful websites would do well to try reconfigurations that somehow emulate the browsing and impulse purchase behaviors that brick-and-mortar supermarkets offer.

Suppliers are rapidly introducing offerings that capitalize on the increased consumer demand for healthy foods. Manufacturers are wisely assuming that making these products healthy, plant-based and convenient will appeal to consumers, too. Dole is rolling out its FreshTakes ready-to-eat salad bowls nationally, with four items including meat and two without. All feature clean labels with no artificial flavors, colors or preservatives. In the frozen aisle Nestlé has launched Life Cuisine with offerings grouped by lifestyle: low carb, meatless, high protein and gluten-free. Knudsen has broken out of their traditional category with a line of juice shots that don’t require refrigeration and include ingredients like turmeric, beet and ginger. The demand for local produce has created greater opportunities for Whole Foods partner Gotham Greens. They just opened their eighth greenhouse, big enough at 30,000 square feet to supply seven states with year-round fresh lettuce.

As some consumer demands change and some stay the same, the one thing you can be sure of is that the food supply chain will definitely continue to change at an ever-increasing pace.